We started Evolve with the aim of furthering the adoption of Bitcoin. We aim to solve for what we consider to be a big obstacle in the global adoption of Bitcoin, which is Price Volatility.

Bitcoin for the first time in history allows true digital ownership of an asset without a centralized third party custodian. Previously, ownership has only been possible with bearer assets like cash. Bitcoin eliminates the centralized custodian while guaranteeing security and fidelity of property rights.

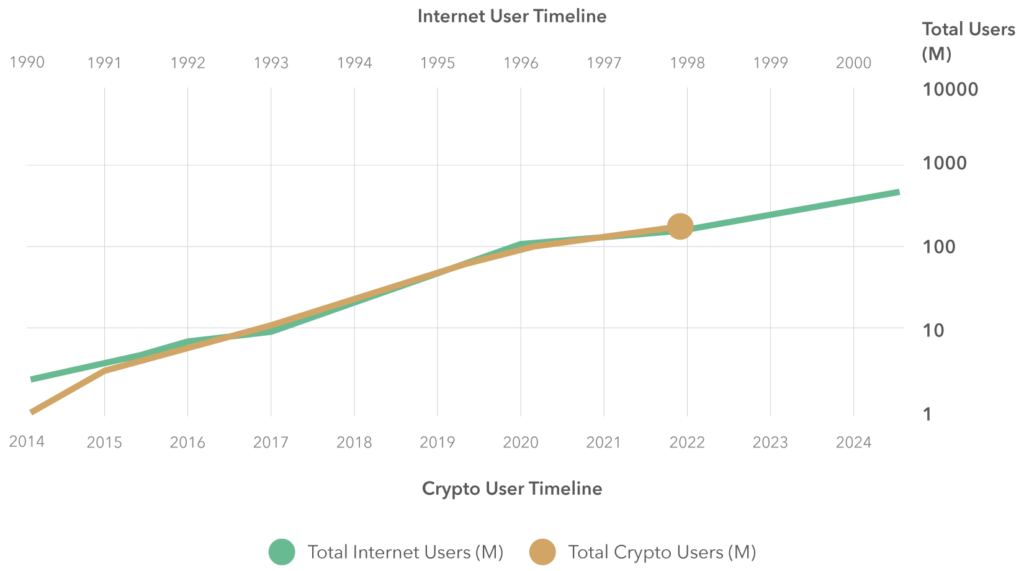

~1 Trillion USD

the market Capitalization of Bitcoin

~200 million

the number of active BTC users worldwide

45%

share of the entire cryptocurrency market capitalization held by bitcoin

>70%

the supply in BTC is held by HODLers (Holding on for Dear Life)

Source: World Bank, Crypto.com

Note: All numbers mentioned above are targets for the fund. We will try to maximize off exchange storage.

Our objective, in order, is to reduce drawdowns significantly while capturing a high participation in the upside. The team has the expertise and experience to execute effectively. Our systematic derivate trading strategies are highly scalable, in a market with daily options traded volumes of $15-20Bn and growing.

Portfolio protected from Left-Tail Risk through the ownership of puts.

Right-Tail Risk is mitigated by selling a maximum of 75% of the Bitcoin exposure, hence Right-Tail Risk is capped at 75%.

Portfolio protected from Left-Tail Risk through the ownership of puts.

Right-Tail Risk is mitigated by selling a maximum of 75% of the Bitcoin exposure, hence Right-Tail Risk is capped at 75%.

The coin is stored in a secure cold storage wallet off the exchange.

Trading decisions avoid using autonomous algorithms. Trades rely upon an augmented learning approach, to adapt to this emerging market.

Note: All numbers mentioned above are targets for the fund. We will try to maximize off exchange storage.

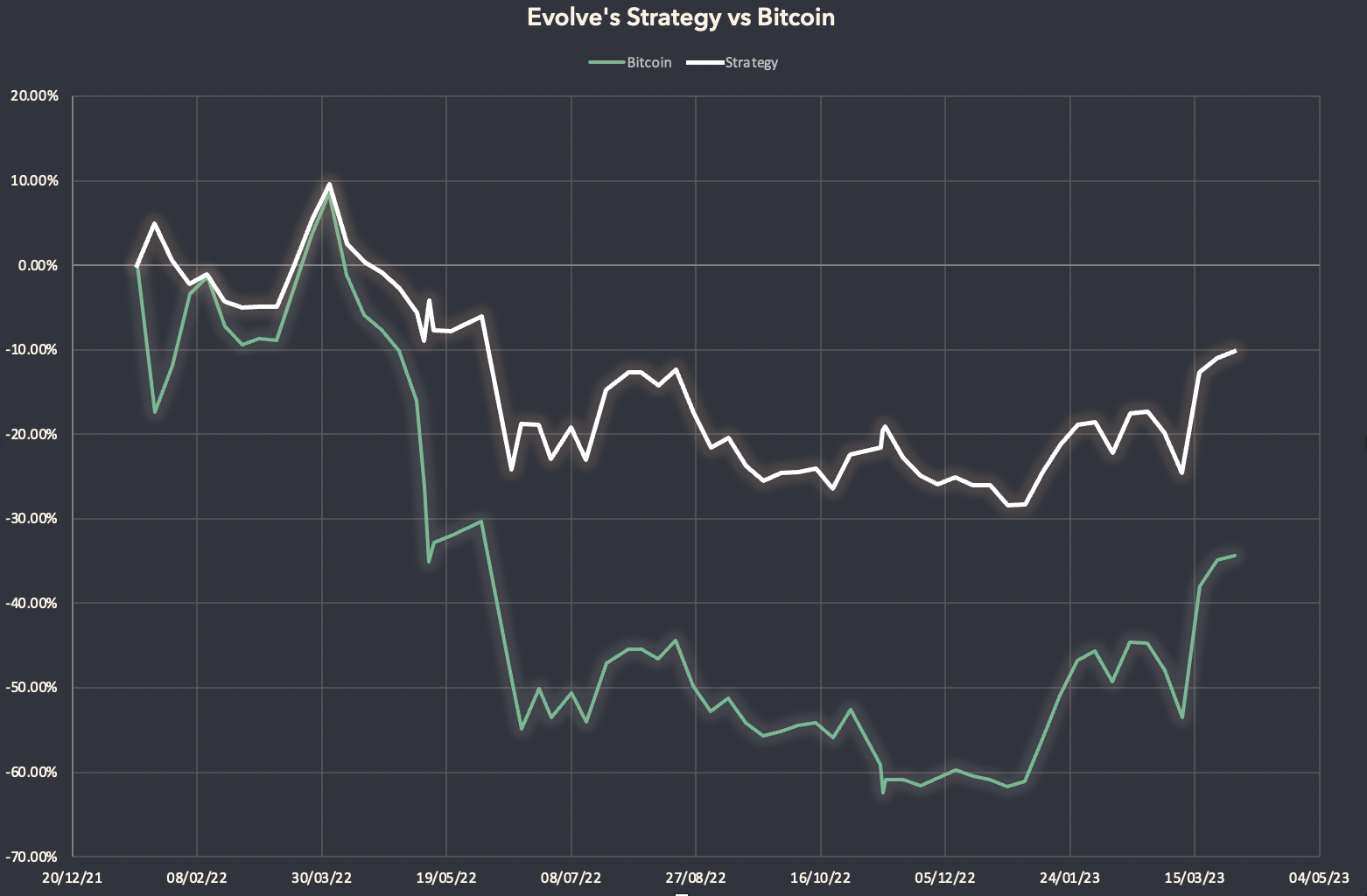

January 15, 2022 – February 24, 2023

-34.37%

Absolute Return of Bitcoin

-10.17%

Absolute Return of Evolve Digital Assets Fund

50.8%

Volatility Reduction of the Strategy

Note: The figures mentioned for the strategy are gross and not net of fees.

Investor digital assets are stored with our custodian, Copper Technologies. It is stored in a MPC cold storage wallet, which is the gold standard for institutional storage.

Copper offers a unique solution for off exchange trading via this wallet. We prevent single points of failure in custody of digital assets and drastically reduce counter-party risk.

Note: We will try to maximize off exchange storage.

Our Team is a group of professionals from India and the US. The trading team has close to 80 years of combined derivative trading experience with global investor base exceeding $100 billion. Their previous firms include Susquehanna International Group and SEI Investments. The management team has experience leading hedge funds and offering wealth management services to UHNI’s.

Administrator: Sterling Bahamas Ltd

Contact: Alan Cole

Mobile: +1 242 424 4128

Email: [email protected]

Custodian: Copper Technologies

Contact: Takatoshi Shibayama

Email: [email protected]

Banking Partner: The Winterbotham Merchant Bank

Contact: Santosha Smith

Email: [email protected]

Reporting: Sterling Bahamas Ltd

Regulator: Securities Commission of Bahamas

Auditor: Deloitte & Touche

NAV: Monthly

Taxation: No Tax on capital gains or trading income in Bahamas, any tax will be charged on repatriation to each investors specific jurisdiction

The Evolve Digital Assets fund is operated under the name of AG Acquisitions Bahamas with a professional fund license, with AG Bahamas Limited acting as the Investment Manager for the fund, having registered offices at Suite 205A, Saffrey Square, Bay Street, Nassau, The Bahamas . The fund is further sub-advised by APE Evolution Advisory LLP and Arin Risk Advisors LLC, having registered offices at 501/502, Kailash Complex, Park Site, Vikhroli, Mumbai -400070 and 1100 E Hector St, Suite 215, Conshohocken, PA, respectively. In addition to risks typically related to investing such as manager error, adverse price adjustments, liquidity squeezes, collateral restrictions, contract restatements, the full value of your investment may be lost due to theft, hacking, lockouts, lost access keys, and custodian bankruptcy or failure. Evolve relies upon third part custodians to assist in the reduction of these risks but there is no assurance such safety measures will be adequate for current or future risks of loss. Evolve’s strategy usually involves a multi-step process. Initially, the investor’s funds purchase Coins/Tokens. The most likely manner for accomplishing this step is by purchasing Coins via an OTC desk via the custodian. Investors should know these fees can be quite high. Evolve will attempt to reduce their acquisition and disposition charges by surveying the various exchanges and OTC desks but no such cost reduction is assured. Elevated transaction fees will adversely impact strategy performance. Evolve does not participate in these fees or any other brokerage or custody charges. In addition to simply buying Coins/Tokens, Evolve may choose to replicate the purchase Coins/Tokens by selling in the put options, buying call options or buying futures/forwards. Evolve calls this the “Base Exposure”. In most cases, the Base Exposure will equal one hundred percent (100%) of the investor’s initial deposit less transaction fees. Once Coin/Token exposure is in place, any number of additional trading strategies may be employed. Evolve may seek to optimize various volatility or other arbitrage style trading strategies and/or periodically employ other tactical trading strategies (e.g. relative value, momentum, decentralized financing or “DeFi”, etc.). Evolve seeks to exploit relative levels of implied/realized volatility within a given Coin/Token, between two Coins/tokens, or between a group of Coins/Tokens versus another set of Coins/Tokens. Evolve net exposures may leave accounts exposed to Coin/Tokens market moves and changes in the overall level of Coin/Token volatility. Evolve attempts to reduce the impacts to the strategy from changes in the overall level of Coin/Token volatility. Dynamic hedges and risk-defined option trade structures reduce the directional risk of extreme market moving events. Evolve is typically appropriate for investors seeking to gain exposure to the Coin/Token market in a suffered or risk aware manner. Since Evolve will be reducing the level of risk in the strategy, investors should expect less upside participation should Coins/Tokens rapidly increase in value. Since Coins/Tokens are not well regulated by any government authority, these assets are subject to market manipulation and other malfeasance, including fraud. These risks typically lead to higher levels of volatility in Coins/Tokens relative to other asset classes. Evolve attempts to monetize this increased volatility through various trading techniques with a portfolio of long and/or short options, futures, forwards, common stocks, fixed income securities, commodities, exchange traded funds (“ETFs”). Evolve principally involves trading options based on a Coin’s/Token’s expected market price fluctuation or its implied volatility. Implied volatility is a key feature in the pricing of option contracts. The market price of an option is partially based on the expected volatility, or potential variation in price over time, of its underlying asset as well as supply and demand imbalances. By analyzing the implied/forecasted volatilities of a security, and comparing them to the implied/forecasted volatilities of a historically correlated security, the traders attempt to identify situations where an option on one security is believed to be relatively undervalued and an option on the other security is believed to be relatively overvalued. In selecting the options that Evolve will trade, the traders first identify exchange-traded options with a trading volume sufficient to preclude Evolve’s trades from influencing prices. The traders next evaluate the available investment opportunities and uses a proprietary trading algorithm to assist them in determining when to buy and sell options. The traders may also create hedges, primarily utilizing options, common stocks, futures and ETFs, in an attempt to offset the risk of extreme price movements in the underlying Coin. Such price movements may affect the ability of the traders to implement successfully Evolve’s investment strategy. Evolve seeks to maintain exposure levels that may or may not be neutral to market movements and volatility levels. Evolve may allocate a portion of client capital to short-term, investment grade fixed income instruments, including United States Treasury Bills, money-market instruments, money-market mutual funds and/or employ other trades by the investment manager when they believe the Coin/Token and the options’ markets offer limited investment opportunities. Evolve may hold short-term instruments for an extended period while waiting for other attractive investment opportunities.

In exchange for the management services provided by Evolve, the Client will pay to Evolve a management fee determined at the annual rate of two percent (2.0%) of the Account’s Net Liquidation Value (such value is defined as combination of account additions, withdrawals, asset values, open and closed trades during the period of management) as the Client’s fee (the “Management Fee”). Evolve reserves the right to charge and collect any portion of the Management Fee or any portion thereof at its discretion so long as the Management Fee is valid through the Investment Management Agreement. Evolve reserves the right to waive or charge a lower Management Fee. Each Client and Evolve entered into an agreement through the Private Placement Memorandum (“PPM”). The PPM dictates the manner in which the Client will pay Evolve the investment management fee as well as the duties owed to investors. The terms of which are detailed in the Investment Management Agreement within the PPM. In addition to the Management Fee, subject to reductions as provided herein, Evolve is allocated a Client’s Performance Fee at the end of each Accounting Period, generally December 31 of each calendar year equal to twenty percent (20%) of the excess of the Client’s Net Liquidation Value (as determined by the account’s custodian as of the close of business on the last day of each Accounting Period) over the highest Account’s Net Liquidation Value of the Client’s assets at the end of any prior Accounting Period (i.e., the “Maximum Net Asset Value”). No Evolve Performance Fee will be allocated when the value of an account has fallen below an amount at which the Evolve Performance Fee was previously assessed, or “High Water Mark”. Evolve may, in its sole discretion, waive or charge a lower Performance Fee to any Client. Such Performance Fee shall be paid at any time during the calendar year at the discretion of Evolve, in advance or in arrears. In addition, Evolve reserves the right to waive or to charge a lower Performance Fee to any partner in its sole discretion. The Client bears all administrative fees and expenses relating to the operation of the Client’s Account including, but not limited to, investment expenses, legal, accounting, administrative and other direct expenses, travel and other expenses incurred in connection with the continued management of the Account and any extraordinary expenses. The Client will also pay directly, or reimburse the Evolve for, all expenses incurred in connection with the organization of the Client Account. Such organizational expenses are generally negligible but Client acknowledges any organizational expenses will be amortized by the Client using the straight-line method over the first twelve (12) months of the Client’s engagement of Evolve. Evolve may, in its discretion, waive the cost or charge the Client lower organization, administrative and operational fees.